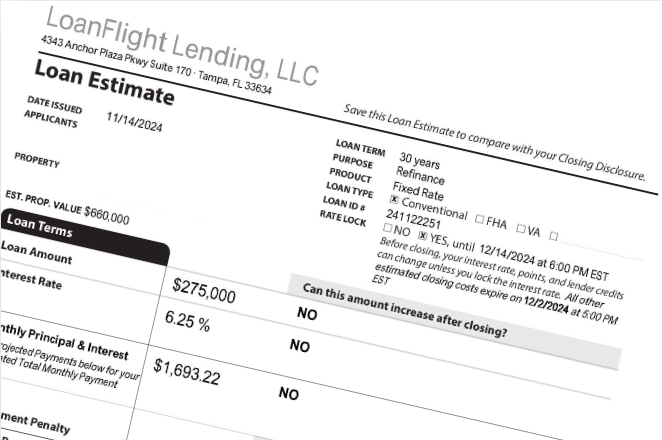

If you’re in the process of buying a home or refinancing your mortgage, one of the most important documents you’ll encounter is the Loan Estimate. This document, provided by your lender, gives you a detailed breakdown of the costs and terms associated with your loan. Knowing how to review it can save you money and help you make a confident decision. Here’s what you need to know. Please note the loan estimate images used in this post are just an example and should not be used to estimate costs or quote a rate. Please click here to complete an application if you would like a loan estimate.

Understand the Purpose of a Loan Estimate

The Loan Estimate is a standardized, three-page document designed to make it easy for borrowers to compare loan offers from different lenders. It includes critical details such as the loan amount, interest rate, monthly payment, and closing costs. By law, lenders must provide this document within three business days of receiving your loan application.

Key Sections of the Loan Estimate

Let’s break down the key sections of the Loan Estimate and what to look for in each:

What Type of Loan Are You Looking For?

Page 1: The Basics

Loan Terms: Check the loan amount, interest rate, and monthly principal and interest payment. Confirm these figures match what you discussed with your lender.

Projected Payments: Review the total monthly payment, including escrow for taxes and insurance. Make sure it fits your budget.

Costs at Closing: This gives you an estimate of the amount you’ll need to bring to the closing table. Pay attention to the breakdown of closing costs versus cash to close.

Page 2: Cost Details

This page provides a deeper dive into the costs associated with your loan. Here’s a walkthrough of each section:

Loan Costs:

Origination Charges: These are fees charged by the lender for processing your loan. Look for excessive fees and ask questions about anything that seems unclear. Hint: look for a lender that charges $0 in lender fees.

Note: An origination fee for discount points is a bona fide fee paid by a borrower to permanently reduce their mortgage interest rate. Lender fees that a borrower should look to avoid are often disclosed as: application fees, processing fees or underwriting fees.

Services You Cannot Shop For: This includes fees for services that the lender requires but you cannot choose the provider, such as appraisal and credit report fees.

Services You Can Shop For: These are services where you can choose the provider, such as title insurance and settlement services. Take the time to shop around and compare quotes to save money.

Other Costs:

Taxes and Other Government Fees: Includes recording fees and transfer taxes. These are generally non-negotiable.

Prepaids: This includes upfront costs for items like homeowners insurance and property taxes.

Initial Escrow Payment at Closing: This is the amount required to establish your escrow account, which will be used to pay property taxes and insurance in the future.

Other: This may include items such as homeowner’s association fees or home warranties. Confirm that these charges are necessary and accurate.

Calculating Cash to Close: This section summarizes the total amount you need to bring to closing, factoring in your down payment, loan costs, and any seller credits.

Page 3: Comparisons and Additional Information

Comparisons: This section helps you see how much you’ll pay in principal, interest, mortgage insurance, and loan costs over the first five years of the loan. It also shows your Annual Percentage Rate (APR) and Total Interest Percentage (TIP).

Other Considerations: This includes details about the lender’s policies on loan servicing, late payments, and refinancing.

What to Watch Out For

Hidden Fees: Look for unexpected charges or high fees that weren’t discussed during the initial conversation.

Rate Locks: Verify if your interest rate is locked and for how long. If it’s not, your rate could change before closing.

Balloon Payments and Prepayment Penalties: Ensure you understand any terms that could increase your costs down the road.

Final Thoughts

The Loan Estimate is a powerful tool that helps you make informed decisions about your mortgage. Taking the time to review it carefully, ask questions, and compare offers can save you thousands of dollars over the life of your loan. With this guide, you’re well-equipped to navigate the process with confidence.

Do you have questions about Loan Estimates or need help finding the right mortgage? Schedule a consultation to speak with a loan officer. We’re here to simplify the process and get you the best deal possible.