In today’s busy housing market, buyers find themselves making as many as 20 offers before one is accepted. Your approval letter could be the difference between getting the home of your dreams and losing it to a competing offer. You might be thinking, “Well, I have a pre-approval letter!” But was that letter underwritten by an actual underwriter?

That one little detail might seem like semantics, but not having an underwritten approval letter could be a major obstacle between you and your new home.

Here’s why. If you are pre-approved by a lender, the lender is likely reviewing only your credit report and loan application, which means your pre-approval is based on the data you entered in your loan application and not on the reality of your financial situation. If your purchase offer is accepted, your loan will still have to go through underwriting, which includes reviewing your assets and income documents. Oftentimes, that precursory review does not accurately reflect what was entered on the loan application and can sometimes result in a loan denial. That means that even if your offer was accepted, you would not have financing for your mortgage.

Starting the process with a fully underwritten mortgage approval makes you a stronger, more credible home buyer while providing you and the seller confidence that the purchase contract will end with an exchange of keys at the closing table.

If you have a pre-approval letter from a lender, let’s review it to determine whether it’s simply a pre-approval letter or if your loan has been approved by an underwriter as well.

Is the underwriter’s name on the letter?

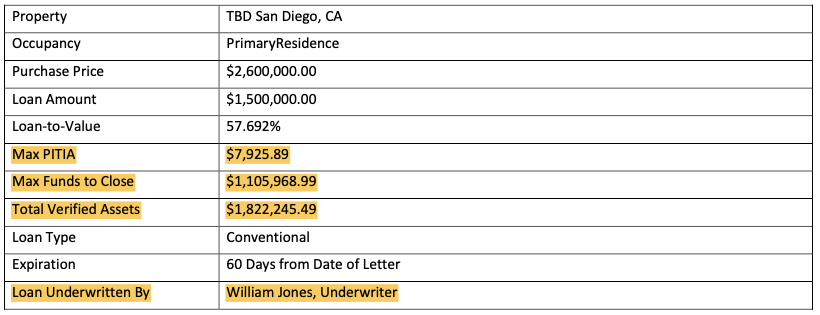

If you only see your loan officer’s name on the letter, that’s a telltale sign that the loan isn’t actually underwritten. For compliance reasons, a loan officer is unable to underwrite any files they originate. Look for a designation that states, “Loan Underwritten By” with an underwriter’s name included. If there is no underwriter’s name, it’s highly unlikely that your loan was fully underwritten.

Is there a maximum PITIA on the letter?

PITIA stands for principal, interest, taxes, insurance and association dues. These are the five most important components of a monthly mortgage payment and will determine affordability. If the home is in a high-tax area or has expensive association dues, it could be the difference between qualifying for a loan and being denied. An experienced seller’s agent will look for the maximum PITIA on your approval letter when reviewing offers.

Were your assets & income verified?

A pre-approval letter will base your eligibility simply on your stated assets and income, without verifying income and asset documents. It’s impossible for an underwriter to approve your loan without verifying assets. While it might seem tedious to supply this documentation in advance, doing so will provide you with a stronger approval letter in the long run. An underwritten approval letter will state your total verified assets as well as your maximum funds to close.

Does your letter include the highlighted fields below?

Get an underwritten approval today

If your lender provided you with a letter that doesn't include the above highlighted items, you have a pre-approval letter instead of an underwritten approval. This puts you at higher risk of losing the home of your dreams to a buyer with a more competitive offer. Perhaps even worse, winning an offer but getting denied for the loan weeks later. If you don’t have an underwritten approval, LoanFlight can fully underwrite your loan within one business day of receiving your completed application and income and asset documents.